Today’s Table Talk is by Ashley Parks, author of The Saving Seed: Growing a Financially Healthy Family Tree. She has so much to share on planting and modeling “good financial behaviors with you children, starting in their youth and continuing into adulthood.” Check out her stuff: thesavingseed.com It’s all about training and equipping our kids to be able to stand on their own.

Thanks for sharing, Ashely… and thanks for walking the road with me.

-Kay

Adolescence can be a very challenging time for both children and adults, but it’s also a wonderful time to see your children bloom. You’ve planted healthy seeds in your children and they have been germinating in them for some time. It’s time for those seeds to really take root so they can grow. This can be a time during which a great shift occurs. Parents may start to see power struggles and peer-pressure increase, not to mention puberty. Ensure your child is aware of family rules and consequences. Family meetings are very important during this time, so you’ll be glad you started this tradition years ago. If your child is expecting a car when they turn 16, this may be a good time to discuss budgeting and show your child what they would need to save for that goal. Set the expectations early on to avoid some conflicts down the road.

Dr. Andrew McGarrahan, a child psychologist in Dallas, Texas, works with children ranging from age 8 to young adults in their 20s. According to Dr. McGarrahan, around middle school is the time when children may no longer do things just to please you. They feel more grown up and are more apt to work for incentives than their earlier desire just to please you. They need to be responsible around the house, for example, cleaning their room and taking out the trash, as part of being in the family. Incentives are a way for your children to earn an allowance for doing something extra, and above and beyond what’s already expected.

Parents and children need to work together to arrive at what the incentive is and how it is earned. Talk to your child about what motivates them, what they want to work for, so that the incentive really does drive them. As a parent, you want them to get the reward and to succeed. Be clear about how they earn the incentive and when they receive it. Video games tend to be the activity of choice for this age group. Allow your children to be incentivized so if they do some additional chore, like helping in the yard or around the house, you would in return give them money for a video game. For younger children, they may choose stickers or a smaller reward for their work. According to Dr. McGarrahan, it’s important to make sure that the incentive, the video game, is something that they buy for themselves—not something you would normally give. It needs to be that special thing they’ve earned for themselves. Instead of buying the item for them once they’ve saved enough money, take them to the store, have them pick out what they want and have them pay for it out of their own pocket. (McGarrahan)

Engage them in the process. If they want something a bit more expensive, you may make an agreement to match a portion of the money they’ve saved once they reach a certain dollar goal. This is a real-world lesson in saving for a goal. By matching a portion, you are exposing them to what it may be like if an employer matches a retirement plan contribution or to have a job with an incentive for a bonus. This early exposure plants seeds that add to the myriads of other tidbits of information that shape someone’s financial knowledge.

As your children get older, allowance alone may not be what it takes to motivate them. Privileges may be a way to do just that. You may allow them the privilege of computer time once they’ve completed their homework. Other ideas could be allowing them to pick out what to have for dinner or what movie to rent for Friday night. Again, make sure the incentive is something your child actually wants. Otherwise, they probably won’t stick to it for long. Similarly, the lack of doing homework may mean a privilege is taken away. Be specific and clear with your child about the rules, and be consistent with enforcing them.

Growing Seeds:

Incentives

Increased Responsibilities

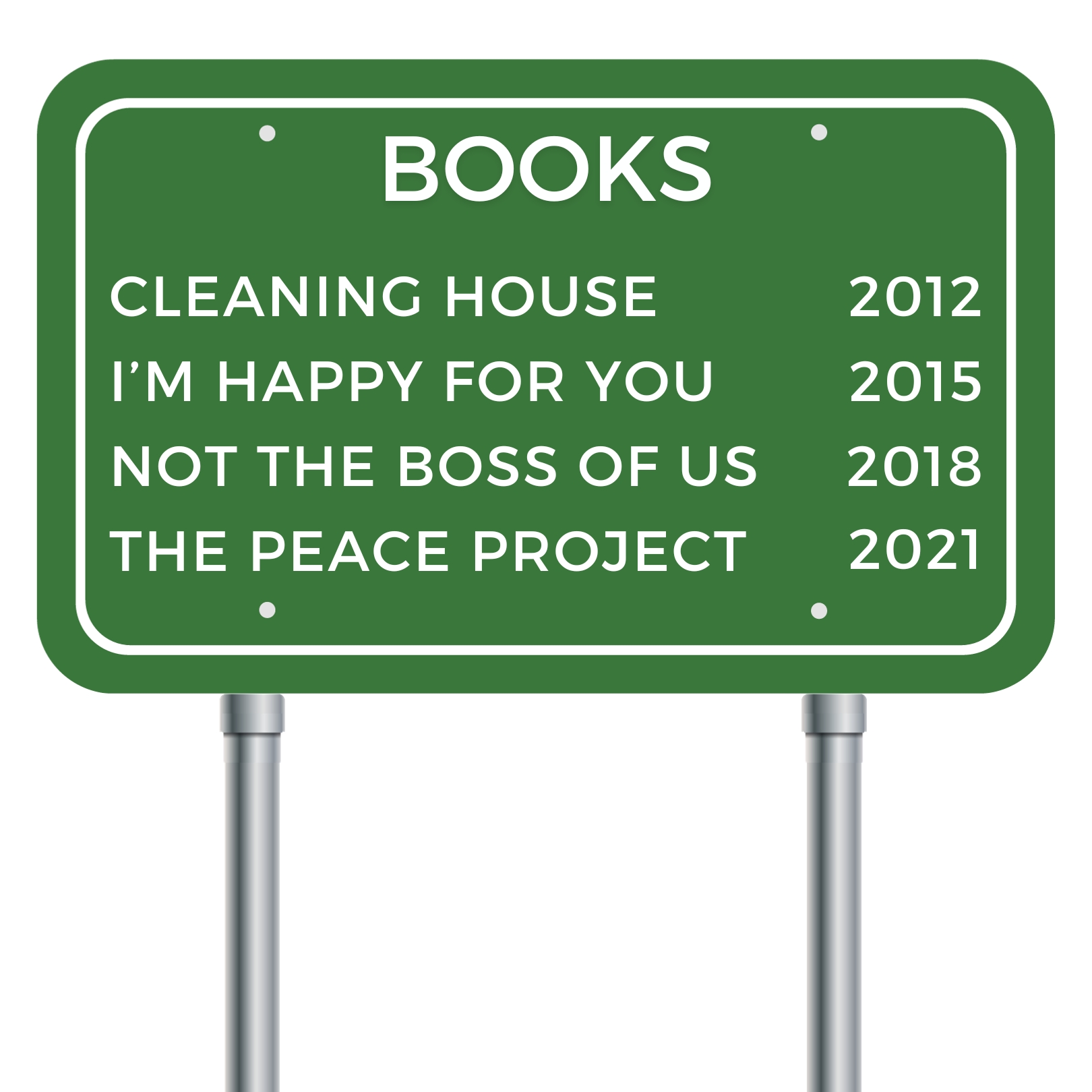

Excerpt from: The Saving Seed: Growing a Financially Healthy Family Tree

By Ashley Parks, CFP. Ashley Bogard Parks, CFP® holds a Bachelors of Business Administration from Texas A&M University and a Graduate Certificate in Financial Planning from Southern Methodist University. She has been advising clients since 1999 in her hometown of Dallas, Texas where she resides with her family.